In an era where financial technology defines convenience and connectivity, Pasonet emerges as a groundbreaking digital payment gateway designed to simplify how individuals and businesses handle online transactions. It is more than a payment processor; it’s an integrated ecosystem that enables users to send and receive money, make online purchases, pay bills, and manage cross-sector financial operations with efficiency and confidence.

Table of Contents

The Vision Behind Pasonet

Pasonet’s vision is to empower users by offering a trustworthy, accessible, and technologically advanced payment solution. Traditional banking methods often involve delays, high transaction fees, and limited accessibility, especially for small businesses or individuals in developing regions. Pasonet seeks to overcome these limitations by offering a digital-first approach that blends speed, transparency, and global reach.

READ ALSO: MyFastBroker: Your Partner in Global Trading Success

Benefits of Using Pasonet

For Individuals

- Easy and Smooth Transactions: Transfer or receive money within seconds at any time and location.

- Financial Control: Visibility, control, and spend money effectively through a custom dashboard.

- Security Assurance: You will have the assurance of good security of your financial details because they are backed by the most up-to-date encryption measures.

For Businesses

- More Accelerated Checkout Workflows: Dilute cart abandonment and make more sales by making payments a painless experience.

- International Adoption: International Customer Receipt: receive and accept international customer payments in various currencies.

- Scalability: Scale with ease and modular tools and integrations.

it combines convenience with innovation in order to enable businesses to develop and people to conduct transactions with confidence.

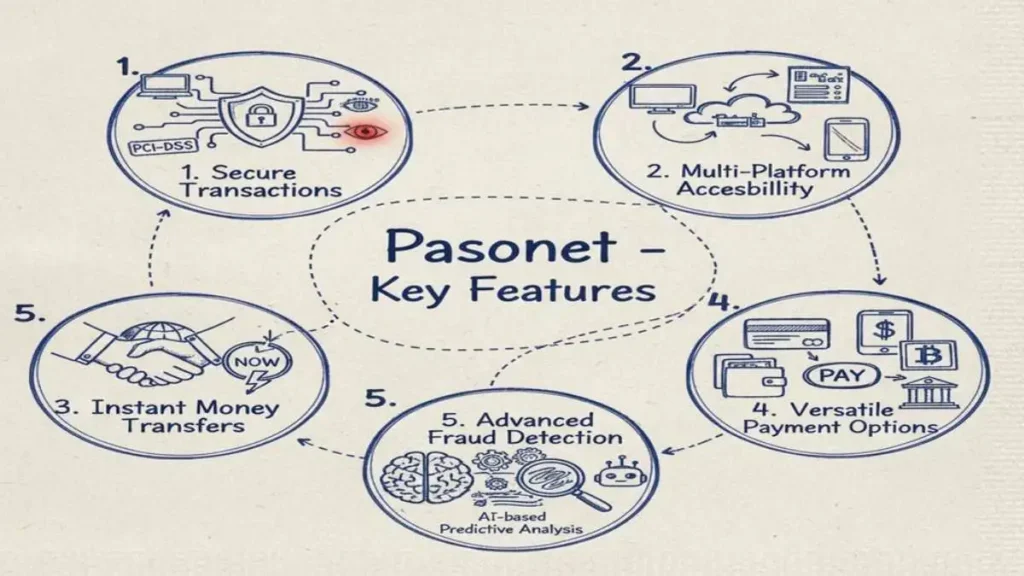

Key Features of Pasonet

1. Secure Transactions

Security is at the core of its infrastructure. Every transaction is protected using SSL encryption, tokenization, and real-time monitoring systems that detect suspicious activities instantly. The platform complies with PCI-DSS (Payment Card Industry Data Security Standard), ensuring global protection for cardholders and merchants alike.

2. Multi-Platform Accessibility

It is accessible across multiple platforms, including web browsers, Android, and iOS devices. Its intuitive dashboard provides users with a unified experience, allowing them to track payments, generate invoices, and manage finances from anywhere.

3. Instant Money Transfers

Gone are the days of delayed transactions. With its optimized payment routing, funds are transferred in seconds, regardless of location or device. Whether it’s a business-to-business payment or a personal remittance, users can expect instant settlement and confirmation.

4. Versatile Payment Options

It supports a wide range of payment methods, including credit and debit cards, mobile wallets, bank transfers, QR payments, and even cryptocurrency transactions in select regions. This flexibility makes it a one-stop solution for both traditional and modern payment preferences.

5. Advanced Fraud Detection

Using AI-based predictive analysis, it continuously scans transaction data to detect and prevent fraudulent behavior. The system employs machine learning algorithms that learn from past patterns, ensuring proactive security against evolving cyber threats.

How Pasonet Works

It is a centralized payment gateway that integrates merchants, customers, and financial institutions on one platform that is secure. The system allows real-time allocation of funds and supports the multi-channel transactions of numerous financial operations.

- Registration and Verification: Users the users will establish an account and validate their identity with KYC (Know Your Customer) to confirm conformity and safety.

- Payment Integration: Payment can be integrated into the websites, e-commerce stores, or apps of businesses so that customers can check out and process payment through Pasonet.

- Transaction Execution: Users can send or receive payments in real time, be it during online shopping, paying bills, or conducting business.

This has been a simplified process, which means that the user will have little friction when making transactions but will still have the highest level of security and compliance.

Use Cases Across Sectors

Its versatility allows it to cater to a wide range of sectors:

- E-Commerce: Enables secure checkout experiences, boosting customer trust and sales conversions.

- Education: Facilitates tuition and online course payments for schools and universities.

- Healthcare: Simplifies medical bill settlements and telemedicine transactions.

- Utilities and Public Services: Streamlines recurring bill payments for electricity, water, and internet services.

This multi-sector adaptability positions it as a universal payment solution suitable for both local and international markets.

The Technology Behind Pasonet

It is an advanced encryption, blockchain-imitated transparency, and cloud-scale that allows it to operate on a solid digital foundation. It has a secure design that authenticates every transaction, encrypts and documents it exactly as it is, to reduce risks and guarantee the integrity of data.

The platform also applies artificial intelligence and machine learning in order to detect fraud, optimize routing, and provide real-time insights. it is a speedy, reliable, and integrative platform that ensures seamless integration among a wide range of financial platforms due to its API-first infrastructure and adaptive algorithms.

Pasonet’s Role in Financial Inclusion

The best thing it has done is its dedication to financial inclusion. In most developing areas, the conventional banking services are unaffordable to a good number of people. it bridges this gap by:

- Enabling online payments without having to visit bank branches.

- Promoting mobile-friendly interfaces to users who have low internet connectivity.

- Collaboration with the local institutions to enable ready financial flows.

This inclusion means that there is an opportunity for every person, irrespective of geography and economic status, to be part of the digital financial ecosystem.

Why Pasonet Stands Out

Pasonet stands out in a competitive market of fintech by:

- The innovative approach: Using AI, blockchain, and automation to achieve better performance.

- Trust: Being transparent and compliant on all levels of operation.

- Accessibility: Enabling individuals and small businesses to achieve digital finance.

- Price: Competitive fees without affecting the quality of service.

These attributes enable it to be more than a mere payment gateway, but a financial ally of the era of digital era.

FAQs

1. Is Pasonet secure?

Yes. it uses end-to-end encryption, two-factor authentication, and AI-based fraud detection to ensure maximum security.

2. Can businesses integrate Pasonet into their websites?

Absolutely. it offers API integration for e-commerce and enterprise platforms, supporting seamless checkout experiences.

3. Does Pasonet support international transactions?

Yes. it facilitates multi-currency transactions and cross-border payments for global users.

Final thought

Pasonet is rethinking digital payment management globally, uniting speed, security, and simplicity on a single, formidable platform. It enables individuals and businesses to interact smoothly, thereby promoting trust and financial inclusion worldwide. A high-tech encryption, cross-border service, and user-oriented innovation help make it not a mere payment gateway, but the vision of the future of secure, accessible, and efficient online transactions.